Biomedical engineering is a broad field, encompassing most devices and apparatuses that interact with the human body for medical purposes in some way. This report aims to identify the major filers of patents relating to biomedical engineering technologies, determine which territories are of the most interest to patent filers and explore the connection between patent filings and rates of innovation in this field.

A snapshot of the patent landscape

Biomedical engineering technologies represent a large portion of the total patent applications filed across the world each year. At the European Patent Office (EPO), ‘medical technology’ (a category covering most medical devices and apparatuses) was the single largest category of technology by number of patent applications filed in eight out of 10 years from 2012 to 2022[1]. Inventions falling under the umbrella of biomedical engineering rank similarly highly in other major jurisdictions, including the United States[2]. We have examined the available data to identify the major filers of patent applications for biomedical engineering inventions and the territories that are of the most interest to companies in this area of technology.

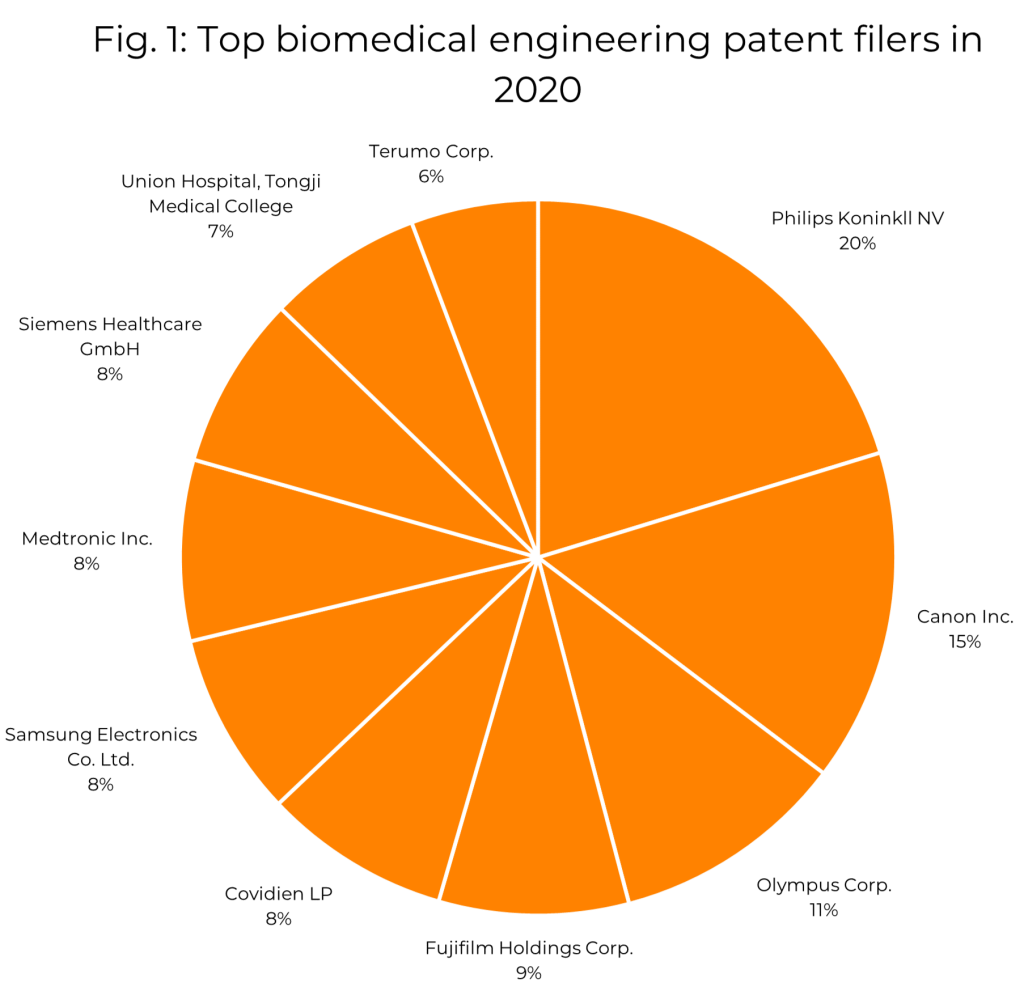

Fig. 1 shows the current 10 largest patent filers in the biomedical engineering sector as judged by the number of patent families in the name of the respective applicant across all jurisdictions with filing dates in 2020 (the most recent year for which full data is available)[3]. Most of these are familiar names such as Phillips, Samsung and Canon, and each of the applicants represented here has been among the top filers in this field over the last decade.

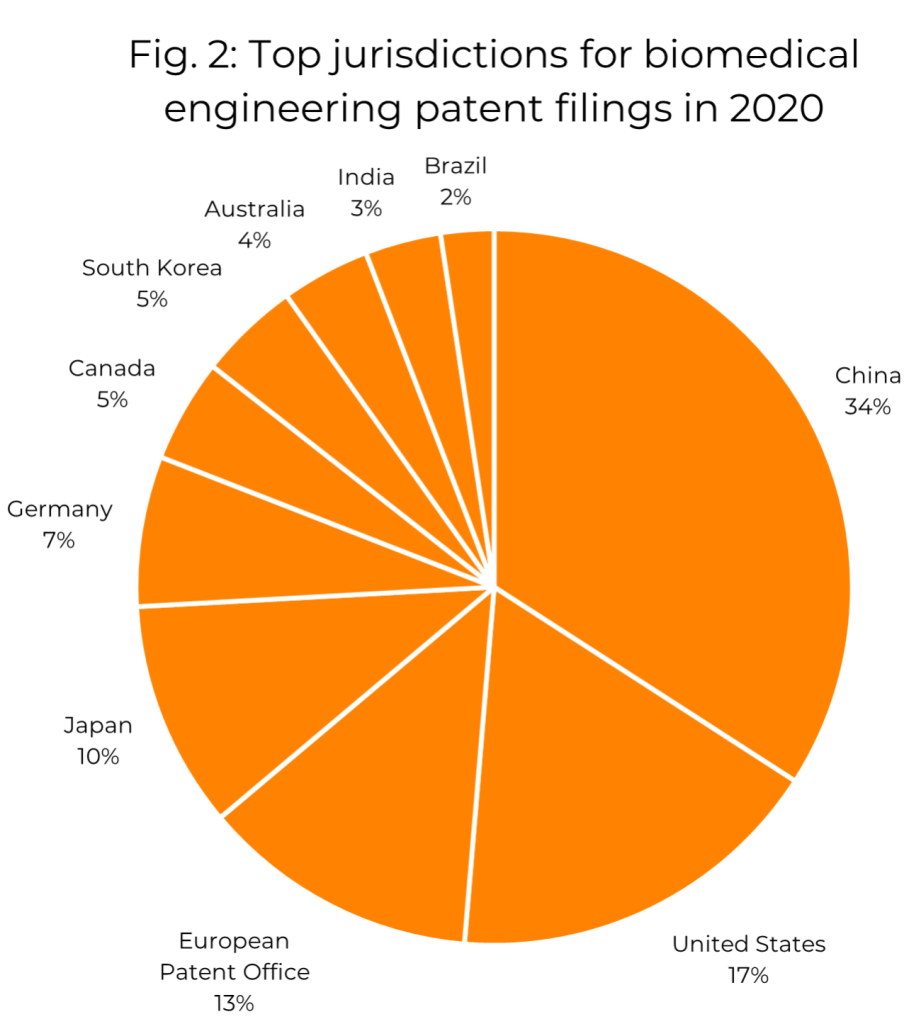

The current most popular territories for biomedical engineering patent filings, again judged by the number of families containing applications published in 2020, are shown in Fig. 2. China, the USA, the EPO and Japan represent the majority of filings in this year as well as every year in the last decade. Though the territories represented here are all major patent jurisdictions, and it is perhaps not surprising to learn that they are popular in the biomedical engineering sector, it is interesting to note that the proportion of biomedical engineering filings appearing in some of these jurisdictions differs significantly from corresponding values for other subject matter. For example, while the EPO represented about 7% of all patent applications published in 2020 across all technologies, it represents 13% of those in the biomedical engineering classes, suggesting that Europe (or at least some European states) is considered an important territory among biomedical engineering companies. The USA and Canada also each represent a significantly larger share of 2020’s patent applications in the biomedical engineering classes than in the figures for all patent applications. In contrast, China represents a lower proportion of biomedical engineering patent publications than it does across all classifications. This suggests that biomedical engineering companies see Europe and North America as valuable markets where the protection of their technology is important.

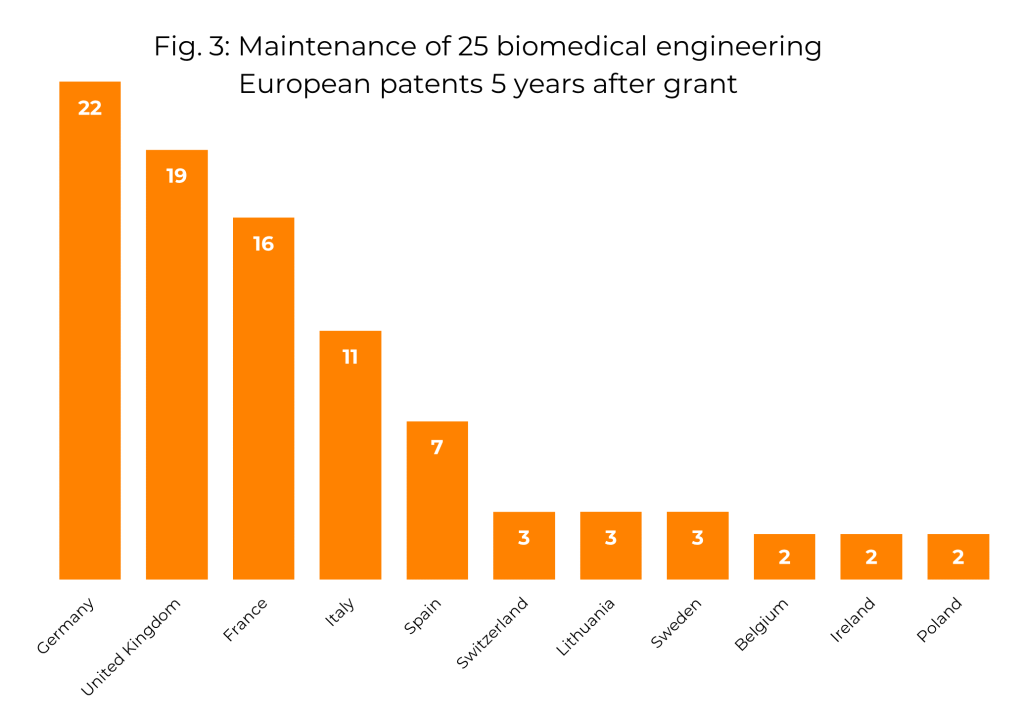

Insight into which European states are of most interest to biomedical engineering patent filers is revealed by investigating which states they choose to make their European patents effective in (since, once granted, the ‘European patent’ is treated as a bundle of separate national patents, and fees must be paid to each national office to keep the corresponding part of the European patent in force). We investigated this in a sample of 25 European patents with biomedical engineering IPC classifications, and for each one we determined which states the patent was effective in five years after it was granted. This information is shown in Fig. 3. It can be seen that the majority of these patents were kept in force in Germany, the UK and France, with a significant proportion also being maintained in Italy and Spain. Only a small fraction of these were maintained in other European states.

With the unitary patent system scheduled to enter into force in 2023, companies will soon have the option to make their European patents effective in 17 European states through a single unitary patent. The unitary patent will cover several of the most popular jurisdictions in the sample just discussed, including Germany, France and Italy – but notably not the UK and Spain – and is maintained through a single renewal fee, which may make it attractive to some patent holders as an alternative to validating the European patent in a large selection of states individually. The vulnerability of the unitary patent to central revocation (such that a successful court challenge would result in the loss of the patent across all 17 unitary patent states) will however make some companies wary of entering their European patents into this system.

Trends over time

Trends in the number of patent filings over time are often taken as a proxy for rates of innovation. For example, increasing numbers of patent filings would suggest an increase in the number of inventions being produced, and hence an accelerating rate of innovation.

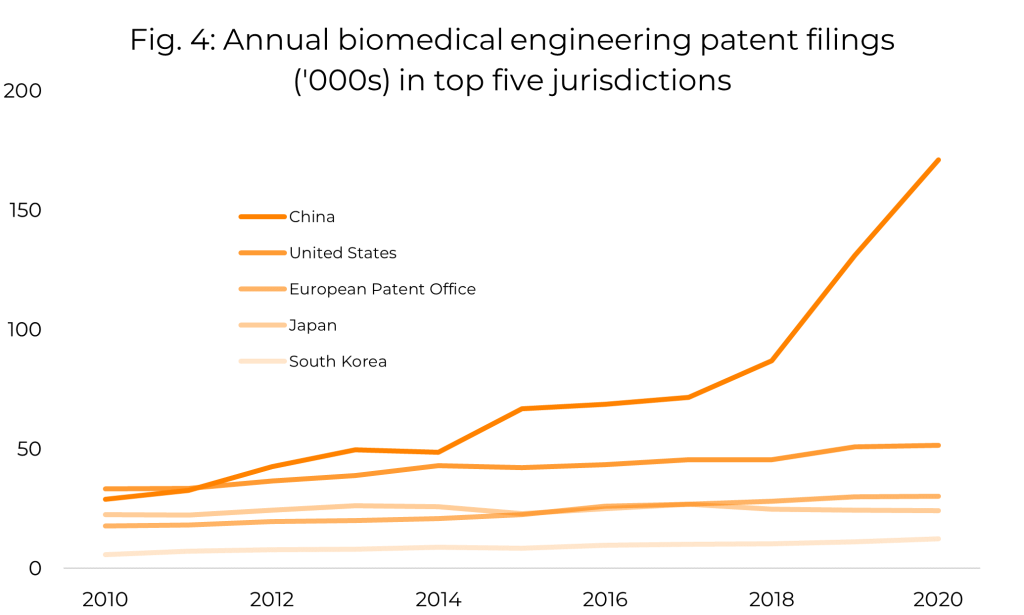

Within the set of biomedical engineering patent classifications, we can see a general increase in the number of patent applications published annually over the last decade. However, when we decompose this data by jurisdiction, we see that almost all of the growth is attributable to filings in China, whereas in other countries, the number of filings per year has been roughly constant in recent years. Further investigation reveals that the majority of these Chinese filings are by Chinese entities, so the apparent global increase in biomedical engineering patent filings appears to be almost entirely due to a surge in domestic filings by Chinese applicants. Figure 4 shows the trend in annual filings from 2010 to 2020 for the five jurisdictions with the largest number of filings in this period.

It is perhaps to be expected that the biomedical engineering field has not seen significant changes in numbers of patent filings globally across the last decade. Biomedical engineering is, at the broadest level, a mature technological field, and while new areas are frequently added to this field, growth in individual areas is unlikely to significantly affect the trend displayed by the field as a whole. It is encouraging that this area of technology continues to produce patents at a steady rate, as this indicates at least a constant rate of innovation.

Is innovation being underrepresented in the patent filing numbers?

While patent filing statistics are often taken to reflect trends in rates of innovation, it should be noted that there is no intrinsic link between these things. Therefore, it is worth considering whether the rate of innovation in biomedical engineering really is as steady as the patent numbers might suggest, or if the relatively mild trends in patent filings conceal a more dynamic reality.

In fact, there are indications that biomedical engineering is experiencing growth in its overall rate of innovation. A 2021 report by EY revealed that, following a decline in the decade leading up to 2017, research and development (R&D) spending in the MedTech sector (of which devices and apparatuses constituting biomedical engineering technology are a principal part) grew every year from 2017 to 2020[4]. Assuming that at least some of this growth in funding is attributable to the biomedical engineering part of the MedTech sector, it appears that there is a disparity between the increasing R&D spending and relatively constant patent filing rates. There are many possible explanations for such a disparity, one of which is that opportunities for patent filings may be being missed. This could be due to innovation taking place outside the realm of what is often seen as traditional patent subject matter (e.g. devices) and being increasingly concentrated in areas such as software. It could also suggest a trend towards more selective, higher-quality patent filings and a departure from the patent thicket strategy traditionally employed by many large entities.

As previously mentioned, an increase in software-related innovations (e.g. computer-aided surgery) may explain why some innovations in the biomedical engineering are not being captured in patent filings. This may be exacerbated by a common misconception that software cannot be patented, an idea that is particularly prevalent in relation to the EPO. This has often led companies to dismiss the possibility of patenting innovations with software aspects but is fundamentally incorrect; inventions that apply software for a technical purpose, as will be the case in almost all biomedical engineering innovations, are eligible for patent protection in Europe.

A further factor that may contribute to the recent mismatch between the growth of the biomedical engineering sector and its patent filings is a lack of awareness of the patent system among some sources of innovation, such as universities. While academic institutions are increasingly partnering with private enterprises to commercialise their research, our experience is that patents are often not considered when inventions are created in such institutions. Failure to protect inventions at this stage can lead to missed opportunities for universities and their commercial partners to attract investment and to exploit the patent in other ways (e.g. licensing the invention to third parties).

Conclusion

To summarise, biomedical engineering is a mature, active commercial sector in which companies clearly see value in protecting their technologies in the world’s major markets. However, as the subject matter of inventions in this field diversifies outside the traditional realm of devices, there is a risk that companies will not adapt their patent strategies, leaving their technology increasingly vulnerable to exploitation by third parties.

If you have questions about the issues raised in this article or any other aspect of your IP strategy, you can find the author’s details here or get in touch via email at: gje@gje.com.

[1] European Patent Office, “European patent applications 2012–2021 per field of technology”: https://www.epo.org/about-us/annual-reports-statistics/statistics.html

[2] Medical technology was the second most popular category of subject matter for international (PCT) applications filed in the United States in 2021: https://www.wipo.int/en/ipfactsandfigures/patents

[3] These figures represent patent families assigned any of the following IPC codes: A61B, A61C, A61F, A61H, A61M

[4] https://www.ey.com/en_us/life-sciences/pulse-of-the-industry