The medical and health technology sectors are in the midst of a period of rapid and sustained innovation. As the more traditional MedTech sectors mature, the rapid ongoing advances in computer technologies are increasingly being applied to solve problems in health and medicine. One of these subsectors which has seen particularly rapid growth in recent years is surgical robotics. In this article we analyse the global patent filing statistics in the surgical robotics subsector to identify the key trends in the field.

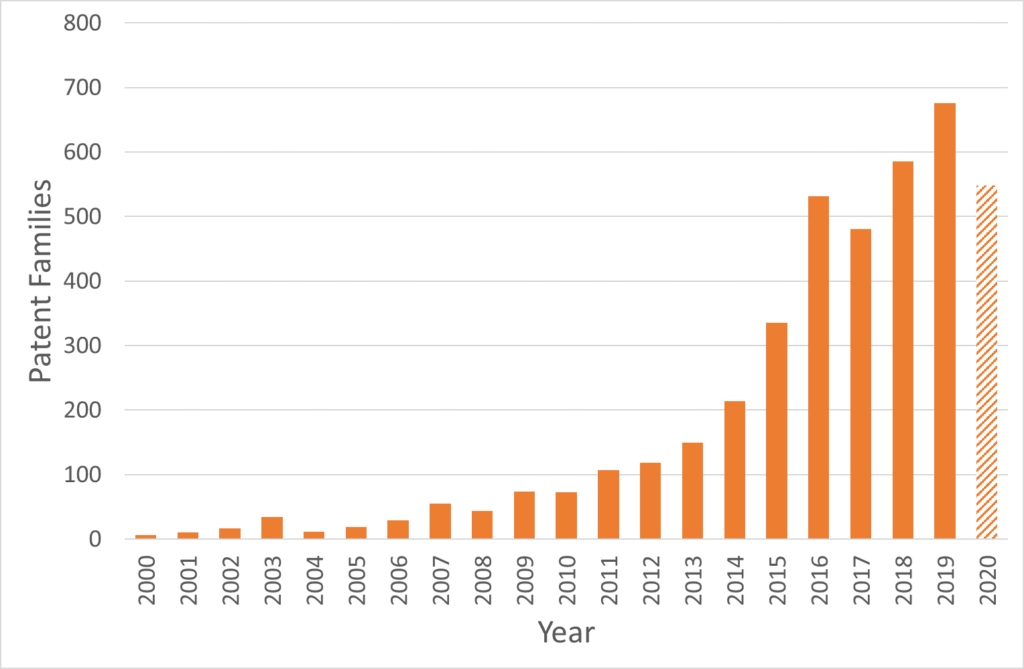

The surgical robotics subsector is at a crucial stage in its maturity. As the graph below illustrates, from a small number of early filings in the sector twenty years ago, innovation has accelerated in the last five years with almost 700 patent families (groups of related patent applications filed across the world relating to the same invention) first published in 2019 – the last year for which full data is available at the time of writing.

Number of new patent families published per year classified under surgical robotics (A61B 34/00)

A patent provides protection to the applicant for up to twenty years from the filing date (subject to the payment of renewal fees). As shown in the chart above, the earliest patents in the sector were publishing around 20 years ago, meaning the earliest surgical robotics patents are now beginning to expire. The expiry of these early broad patents is likely to open up the sector, reducing barriers to entry and providing greater opportunities for newcomers to establish themselves in the field.

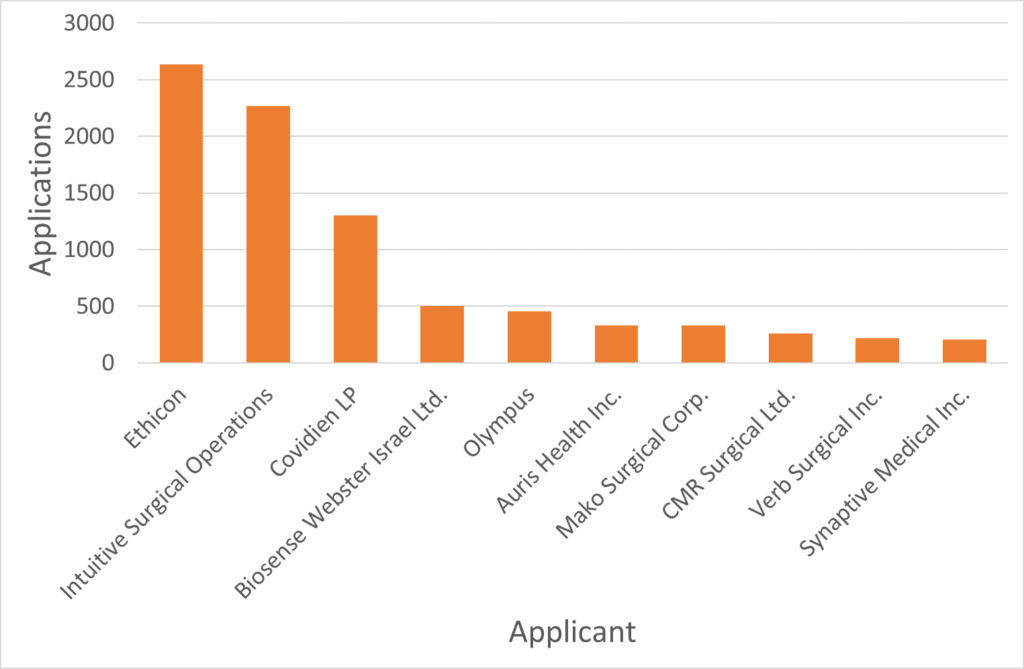

The applicants filing the most patent applications for surgical robotics inventions have been identified below. Although the market is still currently dominated by a small number of large companies based in the USA, there are now a number of emerging European companies pioneering innovative new techniques.

Many of these smaller companies are quickly bought up by the larger market leaders looking to access their patent portfolios and knowhow to strengthen their position in the market. Already this year for example, Medtronic (who purchased Covidien in 2015) acquired British company Digital Surgery [1] and Intuitive Surgical purchased Orpheus Medical [2].

CMR Surgical based in Cambridge (incorporated in 2014), which achieved “unicorn” status with a $1bn+ valuation following its funding round last year [3], has thus far resisted takeover from one of the dominant companies. Instead CMR has built its own vast patent portfolio covering its Versius robotic surgery system which is already being used by several NHS hospitals, as well as others around the world.

Top 10 applicants ordered by number of applications filed since 2015

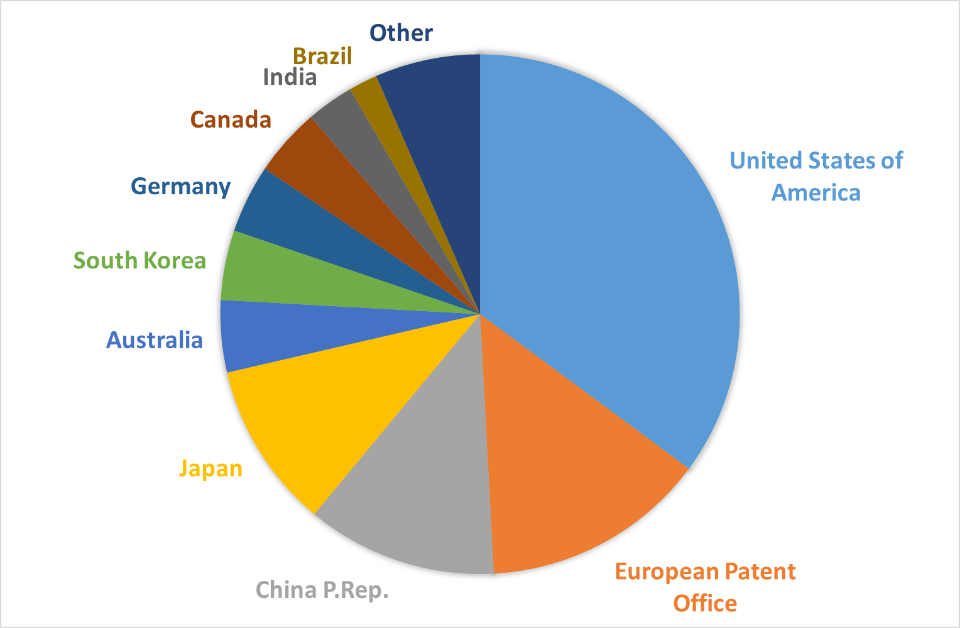

The chart below shows the national patent offices in which surgical robotics patent applications are being filed. Patents are territorial, and therefore in order to prevent competitors from being able to freely manufacture and/or use their invention, applicants must apply for patents in each jurisdiction of interest. The chart therefore gives an indication of the countries that companies in the sector consider to be the main markets for their products.

Currently the USA still dominates with the largest number of applications in the surgical robotics subsector but Europe is clearly seen as an important market, with the second highest number of applications being filed at the European Patent Office.

Top 10 jurisdictions for patent filings in surgical robotics

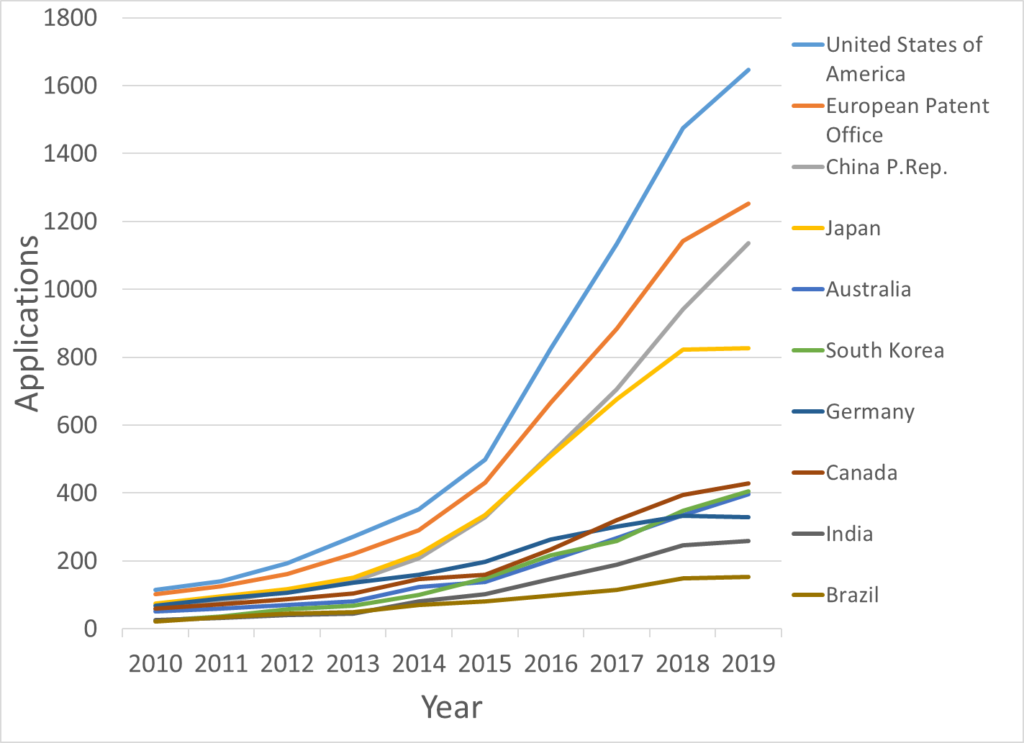

The number of patent applications filed in the last ten years in each of these jurisdictions is illustrated below (with the data for 2020 not yet available). The numbers of patent applications filed in the USA, Europe and China are continuing to increase, with a significant gap now opening up above Japan and the remaining countries.

Number of patent applications filed per year in the top 10 jurisdictions

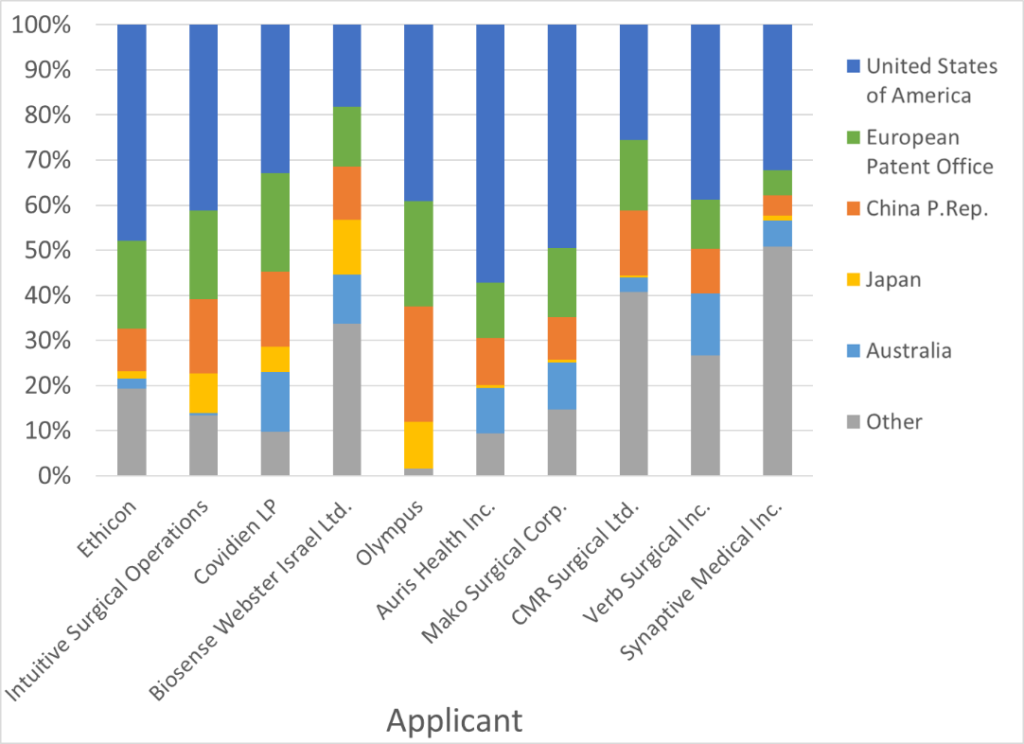

The graph below shows the jurisdictions selected by each of the top applicants and illustrates differences in strategy between the leading companies. For example, it is interesting to note that 98.5% of Olympus’ applications are filed in the top four jurisdictions (USA, EPO, China and Japan), suggesting Olympus take the approach of limiting protection to the largest markets and filing very few applications outside of these crucial countries.

In contrast, CMR Surgical file 59% of their applications at the top five patent offices and Synaptive Medical just 49%. As expected, both of these companies file a large number of applications in their principal place of business. CMR Surgical file 37.5% of their applications in the UK; and Synaptive Medical file 30.5% of their applications in Canada, but the statistics also suggest these companies are targeting opportunities outside of these main markets. This approach is in line with the news last year of CMR’s surgical robotics system being deployed in a hospital in India and used to complete the first set of robotically assisted surgical procedures in humans [4].

Applications filed by top 10 applicants according to jurisdiction

The surgical robotics subsector is at a pivotal stage in its maturity. The efficacy of the technology has now been demonstrated with the first systems now in use in hospitals and the widespread adoption of the techniques inevitable over the coming years. There is also significant investment being deployed in the field, with the sector forecast to grow by almost 25% to over $24 billion by 2025 [5]. This comes at a time when expiry of the early broad patents in the sector is opening the door to a new generation of innovative companies developing and protecting new approaches, utilising recent advances in related fields such as AI and machine vision.

This combination of factors means there will be significant opportunities over the coming years, with those companies developing and effectively protecting the next dominant technologies likely to establish themselves in the market during the widespread adoption of robot assisted surgery in hospitals around the world.

Our specialist MedTech team has significant experience advising on IP strategy in this technology area. Please get in touch at medtech@gje.com if you would like to speak to one of the team or discuss anything in relation to this article.

[3] https://cmrsurgical.com/news/cmr-surgical-raises-series-c-financing