In November 2020 we looked at looked at global patent filing statistics for the preceding twenty years in the computer-aided surgery sector in order to identify the key trends in the field. At the time we set out that the computer-aided surgery sector was at a pivotal stage in its maturity, with those innovating companies developing and effectively protecting the next dominant technologies likely to establish themselves in the market during the widespread adoption of robot assisted surgery in hospitals around the world.

Since then, the computer-aided surgery sector has continued to grow rapidly, with several companies in the sector obtaining significant funding. In the past year, CMR Surgical, which focuses on robotic keyhole surgery, has raised $600 million in a Series D financing round and Memic Innovative Surgery, which focuses on a robotic-assisted surgical platform, raised $96 million in a Series D financing round.

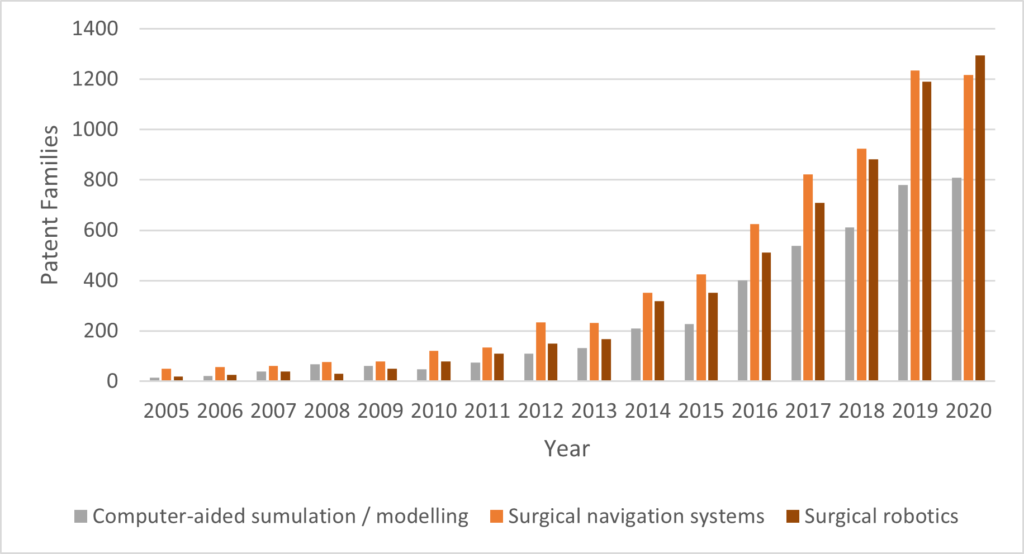

The on-going innovation is reflected in continued growth in patent filings, as the graph below illustrates.

- “Computer-aided planning, simulation or modelling of surgical operations” (A61B 34/10);

- “Surgical navigation systems; Devices for tracking or guiding surgical instruments, (A61B 34/20); and

- “Surgical robots” (A61B 34/30).

As the graph above illustrates, from a small number of early filings in the sector twenty years ago, innovation has accelerated across the computer-aided surgery sector in the last five years. In fact, there were between 779 and 1235 patent families (groups of related patent application filed across the world relating to the same invention) first published in 2020 across the different subcodes – the last year for which full data is available at the time of writing.

Since the earliest filings in this sector, the greatest innovation activity has tended to be within surgical navigation systems and devices for guiding surgical instruments. However, in the last three years, there has been significant innovation in the field of surgical robotics and in 2020 there were more patent families published describing surgical robotics inventions than in either of the other subcodes. This accelerating rate of patent filings in surgical robotics may well be linked to the increased investment focus in this area as commercial systems began to be deployed more widely over this period, with a number of new commercial systems emerging.

Patent filings in the field of computer-aided simulations have generally lagged behind the other subsectors. This may be due to the difficulties in securing broad protection in this area in many jurisdictions due to restrictions on patenting mathematical methods. The recent clarification of the patentability of simulation techniques in Europe should encourage applicants in Europe at least that good protection in this area can be achieved if the invention is framed correctly.

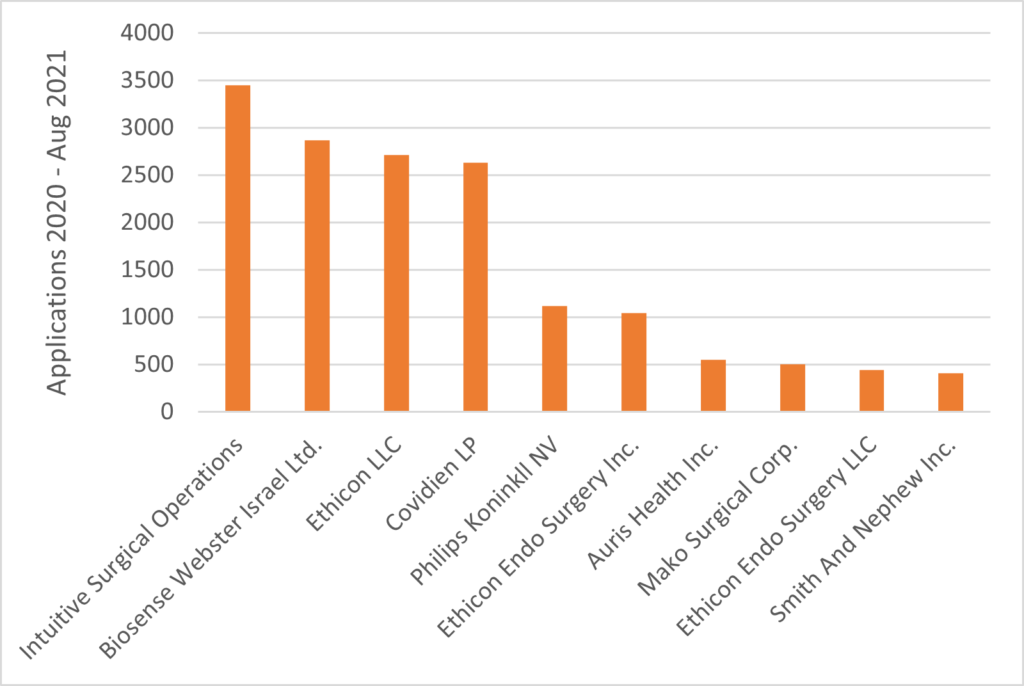

The top patent applicants in computer-aided surgery technologies

The patent filing data also provides a guide as to the leading companies currently most active in seeking patent protection for new computer-aided surgery inventions. The below graph shows the top 10 applicants under the general computer-aided surgery code (A61B 34/00), relating to applications published in 2020 and 2021 (which correspond to applications filed 18 months earlier).

As can be seen, Intuitive Surgical Operations has been the top filer in the field of surgical robotics recently, with close to 3500 application published in this period. In October 2020 they launched their first venture capital fund, with $100 million to invest in early-stage companies with a focus on delivering and supporting the field of minimally invasive procedures.

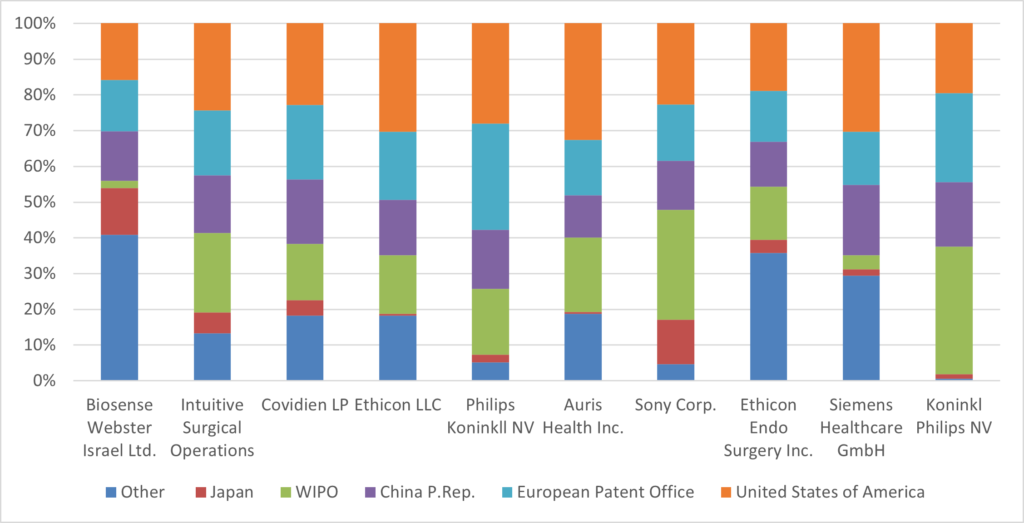

As evidenced by the below chart, these top 10 filers tend to focus their patent filings on the United States of America, the European Patent Office, and China. This is not surprising given these jurisdictions are the largest markets for surgical robotics. For example, roughly 5000 of Intuitive’s Da Vinci Surgical Systems are installed worldwide with roughly 3000 deployed in the US and 1000 in Europe. China is a rapidly growing market with roughly 200 systems installed and an increasing demand, with the average utilisation of each existing da Vinci system reported to be among the world’s highest.

Growing sub-sectors of computer-aided surgery

Rapid advances across computer technologies are increasingly being harnessed in the next generation of medical technologies, shifting the focus of the traditional MedTech sector. It is possible to probe these changes within the computer-aided surgery field by looking into the patent filing data to determine the IPC codes which are cited most frequently alongside the general IPC code for computer aided surgery, A61B 34/00.. The top IPC codes used along-side A61B 34/00 include:

- “Image data processing or generation” (G06T);

- “Manipulators; Chambers provided with manipulation devices” (B25J);

- “Device for introducing media into, or onto, the body” (A61M);

- “Healthcare informatics” (G16H);

- “Filters implantable into blood vessels; Prostheses;…” (A61F); and

- “Electric digital data processing” (G06F).

These areas comprise more traditional surgical technologies, such as manipulators and devices for introducing media into the body that might be expected to continue to form an important component of computer-aided surgical systems. However, there is also a visible shift in innovation focus from more traditional hardware towards software (image data processing, digital data processing) and the use of big data and artificial intelligence (healthcare informatics).

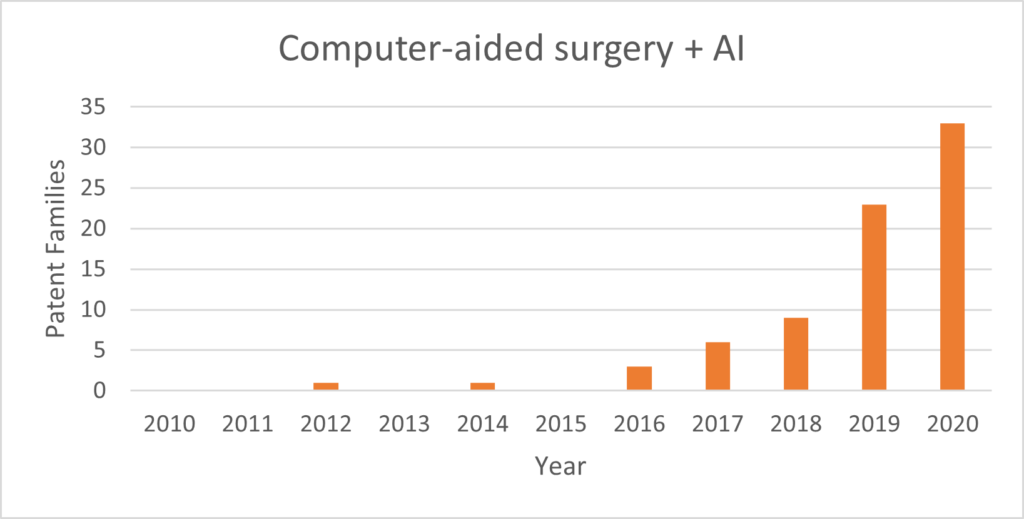

As we have previously discussed, computer-aided surgery falls at the intersection between a number of complex areas of patent law and requires a carefully considered approach to patent strategy to ensure broad protection. In particular, although software and mathematical methods as such are typically excluded from patent protection, so long as the invention provides a “technical effect” beyond implementing the software on a computer, or performing a mathematical algorithm, it may be patented. The EPO recognise that the control of surgical equipment can involve a technical effect. The below graph shows that while small, innovation in the field of surgical robotics using artificial intelligence has been growing rapidly over the last few years.

The top filers in this area include Siemens Healthcare GmbH, Philips Koninkll NV, Intuitive Surgical Operations, and Sony Corp.

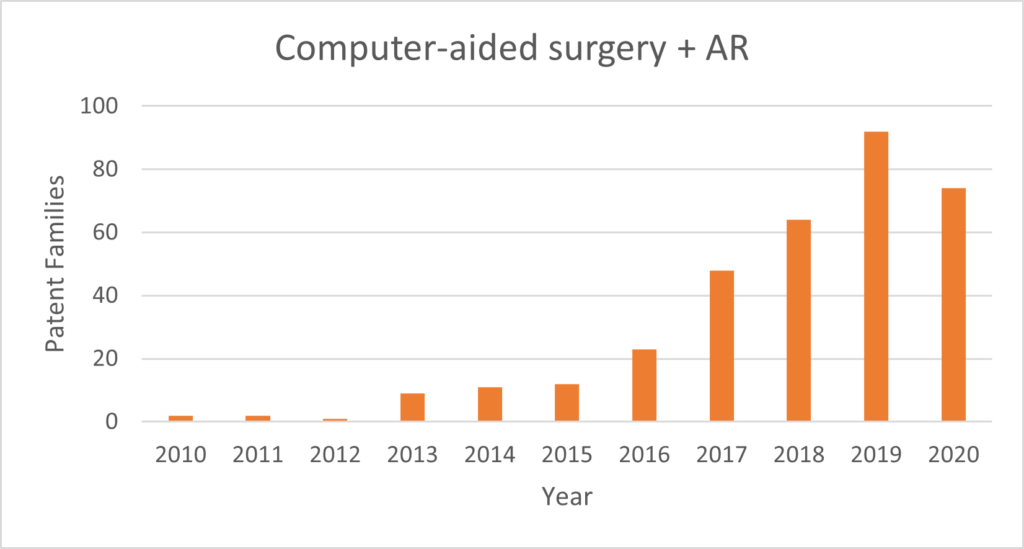

Another subsector of the computer-aided surgery field that we have identified as undergoing significant current innovation activity is the use of augmented reality. The use of AR to present improved information to surgeons to help guide them during operating procedures is a significant current area of development. As previously discussed here, this field bring its own challenges to patent protection, particularly due to the restrictions against inventions that merely involve the presentation of information however again the EPO looks favourably on medical applications and the EPO’s Guidelines to Examination explicitly states that AR that assists surgeons to better perform a procedure is an example of a “technical” application.

This convergence of a number of new digital technologies reaching maturity means there will be substantial opportunities over the coming years. Those companies that are developing and successfully protecting the next dominant technologies are likely to establish themselves in the market during the widespread adoption of computer-aided surgery in hospitals around the world.

Our specialist MedTech team has significant experience advising on the complex IP considerations involved in securing protection for computer-aided surgery technologies. Please get in touch at medtech@gje.com if you would like to speak to one of the team or discuss anything in relation to this article.