RNA therapeutics have cemented their position as a cornerstone of modern medicine since their crucial role in alleviating the damage caused by the COVID-19 pandemic. The development of the mRNA vaccines, used to immunise the world against SARS-CoV-2, was estimated to have saved more than 1.4 million lives in Europe [1] and an estimated $1.15 trillion in the US in additional medical costs [2]. RNA-based treatments also represent lucrative financial opportunities for the companies developing them; Comirnaty was the 7th highest-selling drug in the world in 2023, totalling sales of $11.2 billion [3], despite the WHO declaring the COVID global health emergency over in May 2023 [4]. Indeed, the significant contribution to medicine that RNA-based therapies has made is reflected by the recent award of a Nobel Prize.

As the popularity of RNA therapeutics seems to be steadily on the rise, it prompts the question of whether the patent filing landscape reflects this societal interest.

RNA-based drugs can be classified into four groups based on their structural characteristics and mechanisms of action: antisense oligonucleotides, small interfering RNAs (siRNAs), RNA aptamers and mRNAs. These groups of RNA-based drugs have been the subject of a great volume of research. As an aside, the EPO has published a more detailed “Insight Report” regarding mRNA technologies that further explores the intricacies of mRNA technologies as they traverse the patent filing process [5].

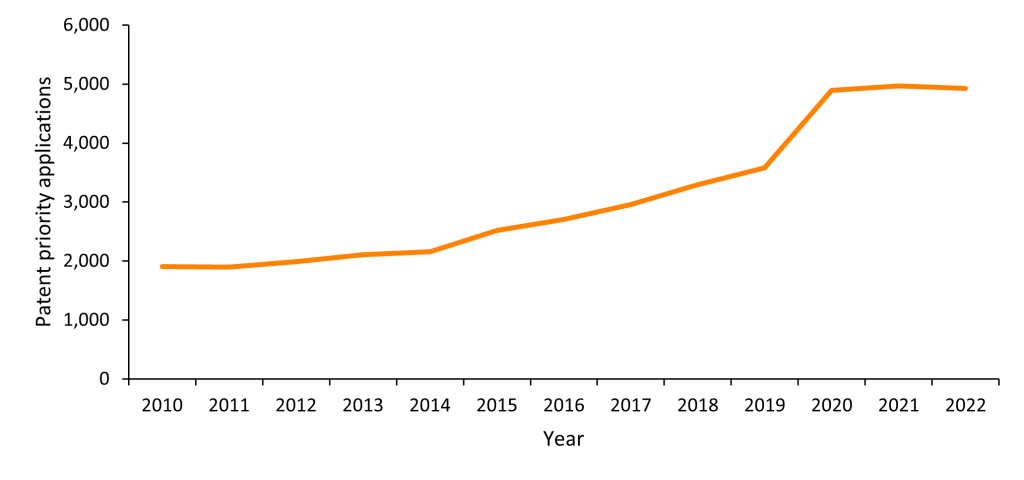

The general trend in RNA therapeutics innovation is clear from patent filing analytics. The below graph (Figure 1) shows numbers of published first patent filings plotted by priority date from 2010 to 2022 whose titles, abstracts or claims contain the keywords “RNA”, “mRNA”, “RNAi”, “siRNA”, “saRNA”, “RNA aptamer”, “antisense oligonucleotide”, “RNA therapy” or “RNA therapeutic” and have the IPC classification code A61 (Medical or Veterinary Science; Hygiene). Figures 3-5 are based on the same parameters but instead plot numbers of patent applications and grants. Patent priority filings have been identified as a useful measure of inventive activity [6] and may provide a proxy for estimating the value invested in research and development at biotech firms.

As shown in Figure 1, between 2014 and 2019 there was a consistent increase in the number of patent priority filings, with 2019 seeing a 66% increase in priority filings compared with 2014. This uptick coincides with a number of recent RNA-related breakthroughs, such as the discovery in 2014 that the CRISPR/Cas9 system could target ssRNA. 2020 was the most significant year for patent priority filings related to RNA therapeutics. This year saw a 37% increase in patent priority filings from the previous year, an effect likely to be attributable to the efforts invested and progress made in the field of RNA therapeutics whilst combating the COVID-19 pandemic. Returning to the general trend seen since 2010, it is also feasible that the uptick in patent priority filings is a result of the implementation of many novel methodologies and computational approaches to RNA therapy development, for example machine learning platforms directed towards the design of mRNA therapeutics [7]. This may have, in turn, prompted the accelerated discovery of patentable RNA therapeutics.

Figure 1. Published first patent filings plotted by priority date since 2010, relating to RNA therapeutics. Source: PatBase.

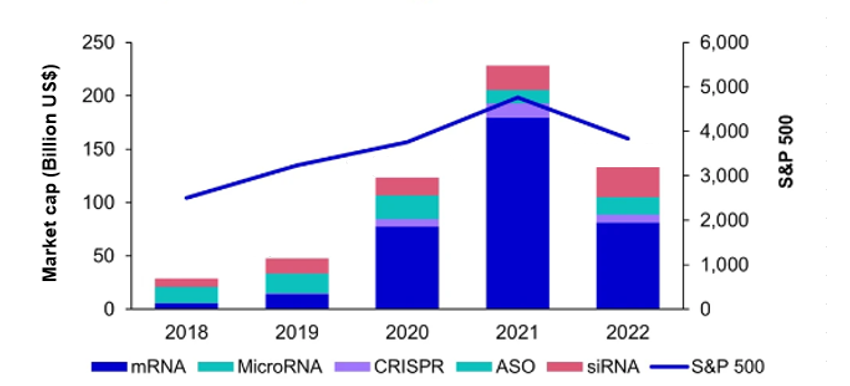

A comparison of patent priority filings since 2019 to the growth rate in the market capitalisation of RNA-based pharmaceutical companies (Figure 2) reveals certain similarities between the two. Following the incredible growth in market capitalisation seen between 2019 and 2021, 2022 saw a return to a level similar to that of 2020. Meanwhile, patent priority filings appear to have levelled off following the significant growth seen between 2019 and 2020. Indeed, it may be the case that the increase in market capitalisation of RNA-based pharmaceutical companies might not have translated to immediate reinvestment into new, patentable RNA therapeutics. The peak market capitalisation of 2021 may, therefore, have been caused in part by the unprecedented success of the SARS-CoV-2 RNA vaccines [8] as opposed to the wider success of RNA therapeutics.

Despite the recent levelling off in patent priority filings and the return to regular market conditions following the COVID-19 pandemic, the vast cost associated with the development of such therapies (the Comirnaty SARS-CoV-2 vaccine cost over $1bn to develop) [9] requires the necessary patent protection to enable companies to recover costs and turn a profit. When protecting drugs and therapeutics with blockbuster potential, the importance of sound IP strategy and watertight patent drafting cannot be overstated.

Figure 2. The total market capitalisation of companies with RNA technology assets, broken down by RNA technology, tracked against the S&P 500. ASO = antisense oligonucleotide. Figure adapted from [7] (Creative Commons license).

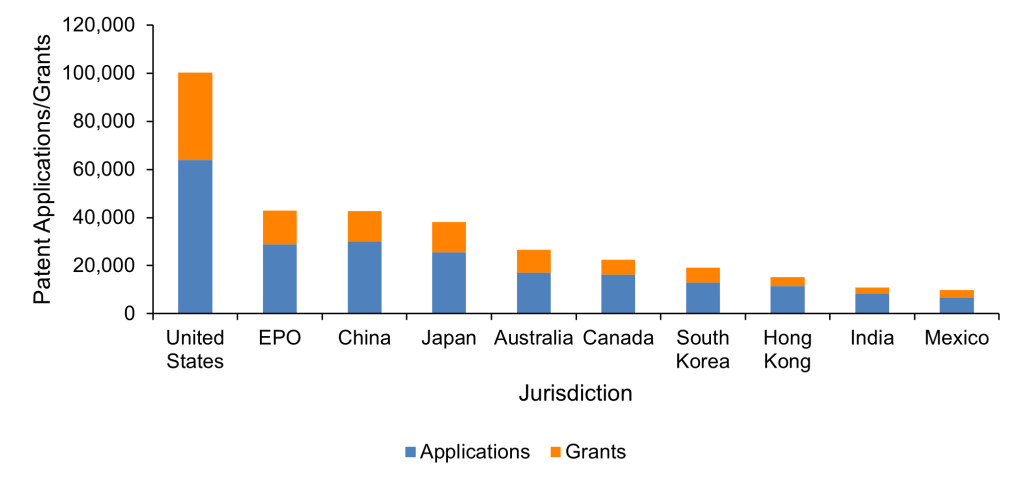

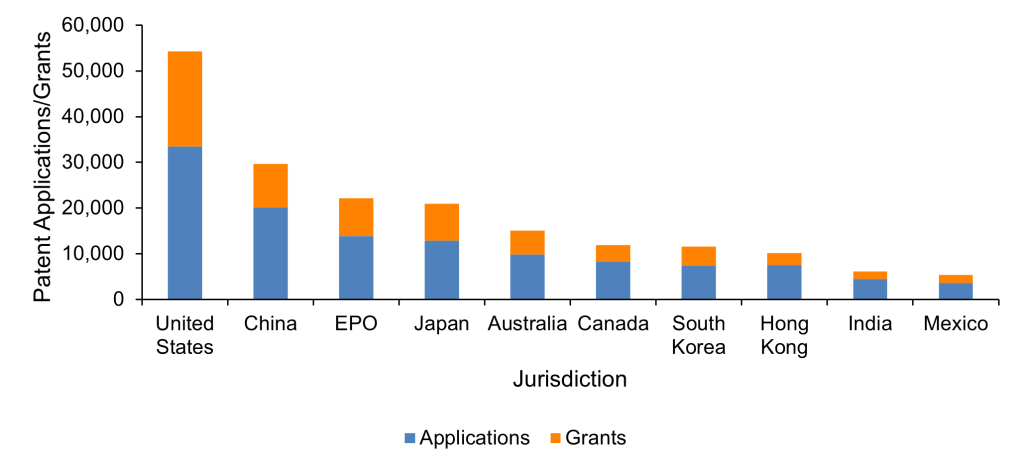

It is also important to consider where in the world RNA therapeutics patents are being sought. Figure 3 shows the number of patent applications and grants in each of the world’s 10 most popular jurisdictions for filing patents since 2005. The United States saw the most RNA therapeutic patent applications and grants, followed by European Patent Office (EPO) and China. EPO patents relate to European Patent applications, a regional application that can be validated in any of the 39 member states of the European Patent Convention once granted. The geographic spread of patent applications and grants shown in Figure 3 suggests that worldwide patent protection is commonly sought for RNA therapeutics, as well as protection in key markets such as the US, China and Europe. As discussed above, the significant investments made to develop such therapies incentivises seeking broad patent protection, to maximise a company’s ability to exploit their innovations effectively.

Figure 3. RNA therapeutics patent applications and grants in each of the top 10 jurisdictions worldwide since 2005. Source: PatBase.

When we look at just the last 10 years, however, the picture shifts slightly. As depicted in Figure 4 below, the US remains the jurisdiction with the most RNA therapeutic patent applications and grants since 2013, while China has risen to second place. The continuation of the US and the emergence of China as key jurisdictions for RNA therapeutic patents reflects the countries’ respective roles as economic and industrial powerhouses, both driven by scientific innovation.

Figure 4. RNA therapeutics patent applications and grants in each of the top 10 jurisdictions worldwide since 2013. Source: PatBase.

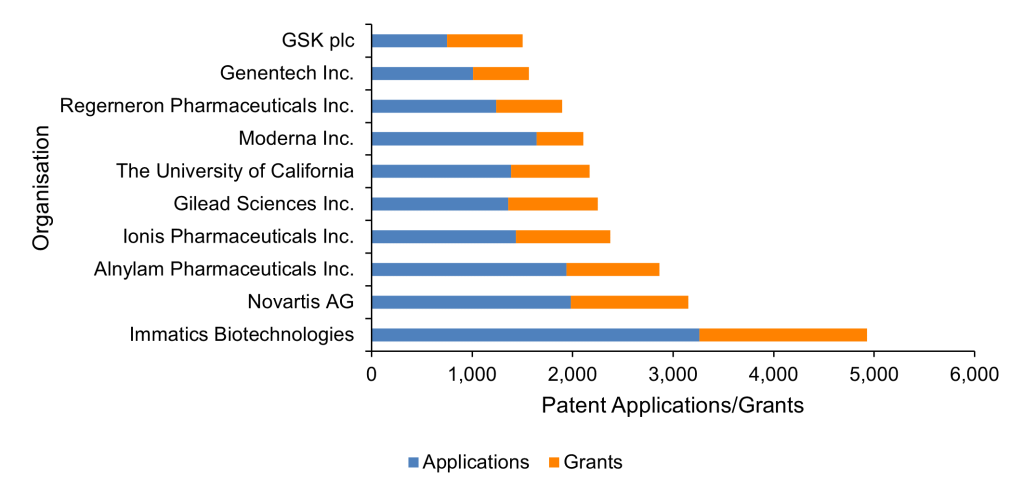

It is also, therefore, unsurprising that seven of the top 10 organisations with the most RNA therapeutics patent applications and grants are headquartered in the US (Figure 5). While the remaining organisations consist of European multinationals, the prominence of US organisations in this technology area would promote the US as one of the jurisdictions of choice for patent protection. Competition between these top companies for market share in the most popular jurisdictions incentivises the generation of robust patent portfolios that protect the resources they invest in research and development of RNA therapeutics. It also forces competitors to innovate further to secure patent rights of their own.

Figure 5. The 10 organisations with the most patent applications and grants relating to RNA therapeutics. GSK = GlaxoSmithKline plc. Source: PatBase.

It is clear to see from patent filing analytics that RNA therapeutics is a burgeoning field of research, with organisations keen to protect their innovations using patents across key jurisdictions.

The biotechnology group at GJE is experienced in patenting RNA therapies, advising both innovative biotech companies and investors. To discuss your biotech IP strategy, please contact your usual GJE attorney or the biotech group at biotech@gje.com.

References

[3] Top companies and drugs by sales in 2023 (nature.com)

[5] mRNA technologies – Insight report – October 2023

[6] The worldwide count of priority patents: A new indicator of inventive activity – ScienceDirect

[8] Breaking the mold with RNA—a “RNAissance” of life science | npj Genomic Medicine (nature.com)

[9] The Price Tags on the COVID-19 Vaccines (managedhealthcareexecutive.com)