Over the last decade, the automotive industry has witnessed a rapid transition towards electric vehicles. In 2018, only 2% of cars sold globally were electric, but this rose to 18% in 2023, representing around a 50% increase year-on-year [1]. However, the marine sector has lagged behind and seeing even small powerboats with electric propellers remains a novelty.

The same problems that have hampered wide-spread adoption of electric cars have also slowed progress in the maritime world. These barriers include a lack of charging infrastructure, high up-front costs and operational drawbacks such as limited ranges and necessary long charging times. These challenges are compounded by the environment which water-borne vessels must operate in. An electric car running low on power half-way through a long trip may be annoying but imagine facing a dead battery a few miles off-shore.

There are signs, however, that this is beginning to change, and the maritime sector looks poised for a boom in electrification over the coming years.

Charging technology and infrastructure has improved following a steady campaign of research and investment. Battery technology itself has advanced a long way in the past decade with practical energy densities by weight of lithium-ion battery cells almost tripling since 2010 [2] and even where batteries have failed to match the horsepower of their fossil fuel counterparts, vessels have been specifically designed to be more efficient under battery power, making top speeds and greater ranges achievable with less power. Stockholm-based Candela has developed electric-powered foiling vessels capable of speeds up to 30 knots and RS Electric Boats has specifically designed the hull shape of its electric rib to minimise drag at low speeds and maximise on the water range.

These advances have, in part, been accelerated by high levels of central investment in the UK. Last year, we wrote about the Department for Transport and Innovate UK’s Zero Emission Vessels and Infrastructure (ZEVI) competition, which made £77 million of funding available to projects which focus on decarbonising the domestic maritime sector. This support has continued with a further £33 million being allocated in January of this year in the fourth round of the Clean Maritime Demonstration Competition, a parallel government competition.

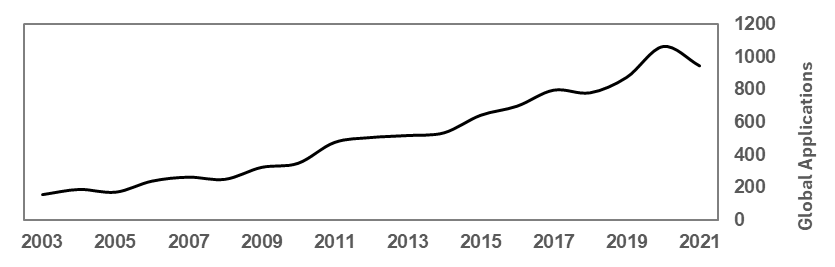

This investment is reflected in global patent filings, where there has been a steady increase in application numbers for electric-powered watercraft over the last two decades.

Figure 1: Number of applications globally for electric-powered watercraft. Source: PatBase.

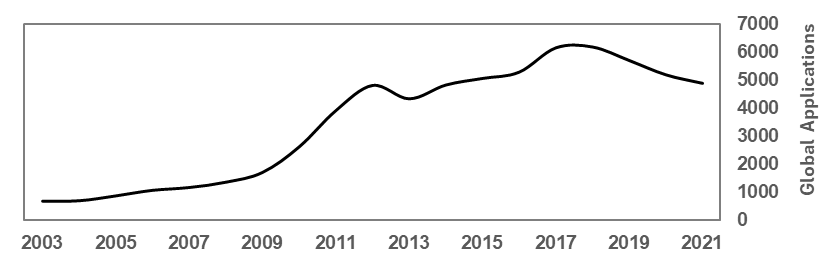

A similar linear growth was seen in patent applications mentioning electric cars in the years from 2003 to 2008, before a dramatic rise began in 2008, the same year Tesla’s first commercially available car, the Roadster, hit the market.

Figure 2: Number of applications globally mentioning electric cars. Source: PatBase.

Whether an exponential increase in filings related to electric marine vessels will occur in the coming years remains to be seen. But, at present, the electric marine industry mirrors the trajectory of the electric car industry in other ways.

Consider electric outboard motors. Just as Tesla dominated the early electric vehicle market, innovation in these electric outboards is largely being driven by start-ups and small businesses. You may never have heard of some commonly cited market leaders such as Torqeedo, ePropulsion, or Evoy. But big-name manufacturers of traditional fossil-fuel powered outboards have thus far lagged behind these start-ups, just as major motor manufacturers did in the adoption of electric vehicles.

Recently, however, large manufacturers have begun to develop their own electric outboards. In early 2024, Yamaha acquired Torqeedo and Honda unveiled its first electric outboard prototype in 2023. These investments might indicate that the large manufacturers think that technology has finally caught up with consumer demand, and that the marine sector is poised for a boom in electrification.

Based on our experience in other sectors, we would expect to see increased patent filings in this area in the coming years as these bigger players with greater resources attempt to protect their investments in R&D.

There remains one key difference between the electric boat and vehicle markets. While Tesla emerged as the dominant early frontrunner in electric cars, no such leader has emerged in the electric boat space so far. In a field with so many successful start-ups, and with more established producers moving in, it looks as though this industry may only become more competitive in the coming years. If a market-leader is to emerge it will need to marry high-performance technology with strong marketing and branding.

With innovation so high in this space, it is clear a solid intellectual property strategy will remain key to any developers looking to carve out their portion of the market share. If you work in the marine sector and would like help with finding the best way to protect your business and its technology, please get in touch with our team at gje@gje.com.

[1] https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-cars